2. What are the qualifying criteria?

You need to be between the ages of 18 and 65, earn a minimum of R5 000 a month and be a

responsible credit user (we check your credit record).

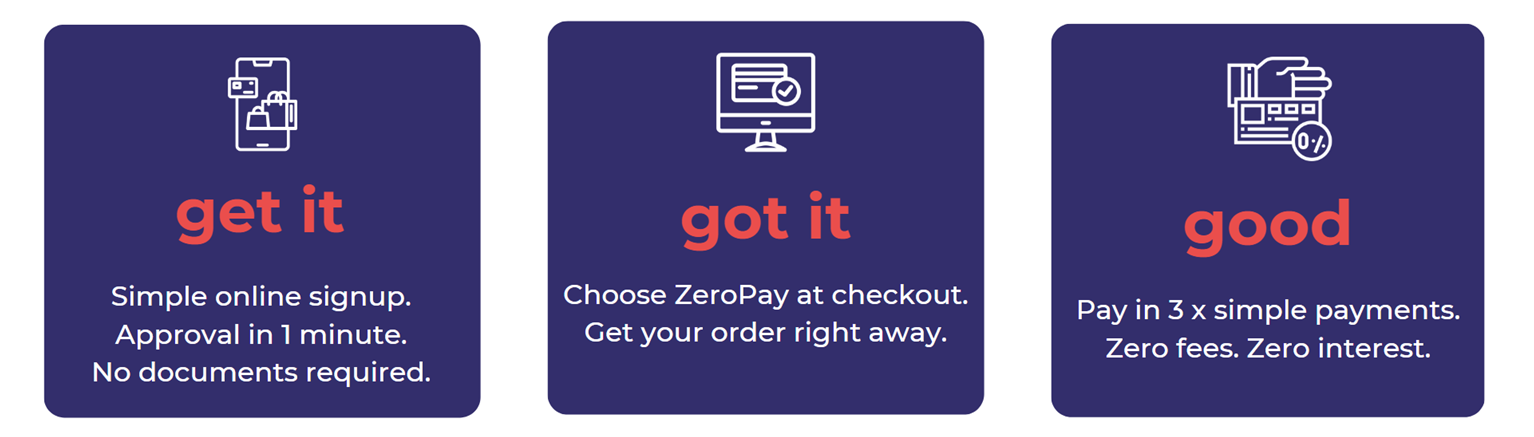

3. How long does the application process take?

If you qualify, your approval is instant as soon as the application has been completed! We

recommend that you do the application before you go shopping, just to ensure you’re ready to

go.

4. What is my spend limit?

You will be approved for a spend limit based on your application at approval and you will be able

to spend once if you’re a first timer. This spend limit is customised to each shopper and is based

on a few factors, including your payment behaviour.

6. How is the monthly instalment calculated?

Depending on the amount you spend and your spend limit, your instalments are split in 3 x Zero

fee, Zero interest payments. If you spend below your spend limit, you will pay 3 x equal payments.

If you spend above your spend limit, your approved spend limit is split in 3 x payments and the

excess amount is paid with the 1st instalment.

7. Are payments really interest free?

Yes – it’s in our name! You will pay Zero fees and Zero interest (only if you pay on time).

8. How do I shop?

Simply select ZeroPay at checkout.

9. How do I pay for my account?

You will load your chosen card details onto your ZeroPay account – Debit, Cheque or Credit card

(all Visa and Mastercard’s accepted).

10. What happens if I cancel my shopping order?

Once your order has been cancelled, the merchant will request for the amount to be refunded on

ZeroPay after which ZeroPay will refund you directly into your back account. Don’t stress, this can

take some time, but we will work to get it back to you soonest!